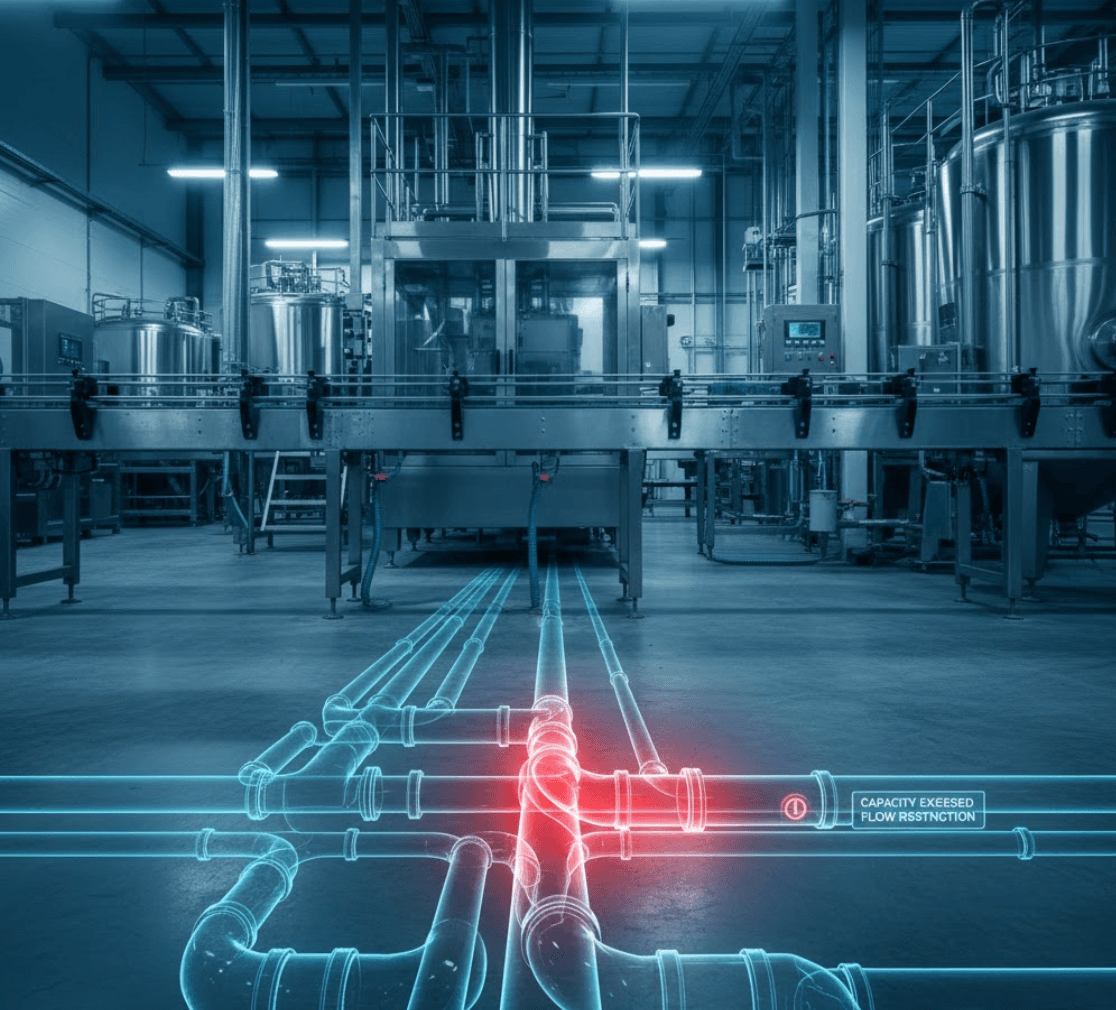

A beverage company upgraded its CIP system to improve efficiency. The new system cleaned faster, generated more volume, discharged more waste simultaneously. On the first production run, the facility's wastewater infrastructure couldn't handle the instantaneous discharge. The floor flooded. Water backed up through floor drains. Uncontrolled stormwater discharge triggered state environmental agency investigation.

The facility faced three problems: 60 hours of production loss, cleanup costs, and regulatory fines. Total impact: $400K. None of it was anticipated during due diligence.

This scenario repeats frequently in food and beverage acquisitions, particularly when plant managers or PE firms upgrade CIP systems, expand production, or implement new process equipment.

The Infrastructure Problem

Food and beverage manufacturing generates continuous wastewater—from product loss, cleaning operations, condensate discharge, and process water. The facility's sewer infrastructure was designed for historical discharge rates. Upgrade a CIP system, and discharge volume increases. Expand production, and total wastewater increases. Add new equipment, and discharge patterns change.

The critical variable that due diligence teams rarely assess: instantaneous discharge capacity.

A facility might handle 10,000 gallons per day of wastewater. If that discharge spreads across 24 hours, the sewer system manages it fine. But if 8,000 gallons discharges in 4 hours (which happens with multi-circuit CIP systems), the sewer line may not be dimensioned for that flow rate. The result: backup, overflow, environmental violation.

The Risk Spectrum

For beverage manufacturers: Wastewater challenges include high Total Dissolved Solids (TDS), brine discharge (if desalination is used), and high hydraulic load during changeovers.

For food processors: Challenges include high Biochemical Oxygen Demand (BOD), variable pH, and grease/solids loading during production cleanups.

Both scenarios require understanding the municipal sewer system's capacity and the facility's typical discharge patterns.

The Due Diligence Gap

Wastewater compliance inspections focus on discharge quality, not capacity. Water treatment reviews focus on incoming water, not outgoing. Environmental due diligence reviews focus on regulatory history, not infrastructure limitations.

Nobody assesses: Can this facility's sewer connection handle 1.5x current discharge volume if we upgrade equipment or run longer hours due to increased sales? That question is critical for any major capital project or operational expansion.

The Assessment Approach

During due diligence, call experienced professionals to assess:

- Instantaneous discharge capacity of sewer connection

- Typical discharge rates by equipment and process

- Municipal sewer system capacity and restrictions

- Cost to upgrade sewer infrastructure if needed

- Alternative discharge strategies (staging, temporary retention, overhead discharge to avoid ground saturation)

This assessment adds 2-3 weeks to operational due diligence but identifies a critical hidden liability (but could be completed in parallel).

The Post-Close Implication

PE firms planning major capital projects or operational improvements must budget for potential sewer infrastructure upgrades. A sewer capacity issue discovered post-close can cost $150K-$500K to remediate—directly reducing Year 1 EBITDA.

Understanding facility wastewater infrastructure during due diligence is foundational to realistic post-close capital planning and environmental risk mitigation.