DUE DILIGENCE

Your Vision. Our Expertise. Informed Decisions.

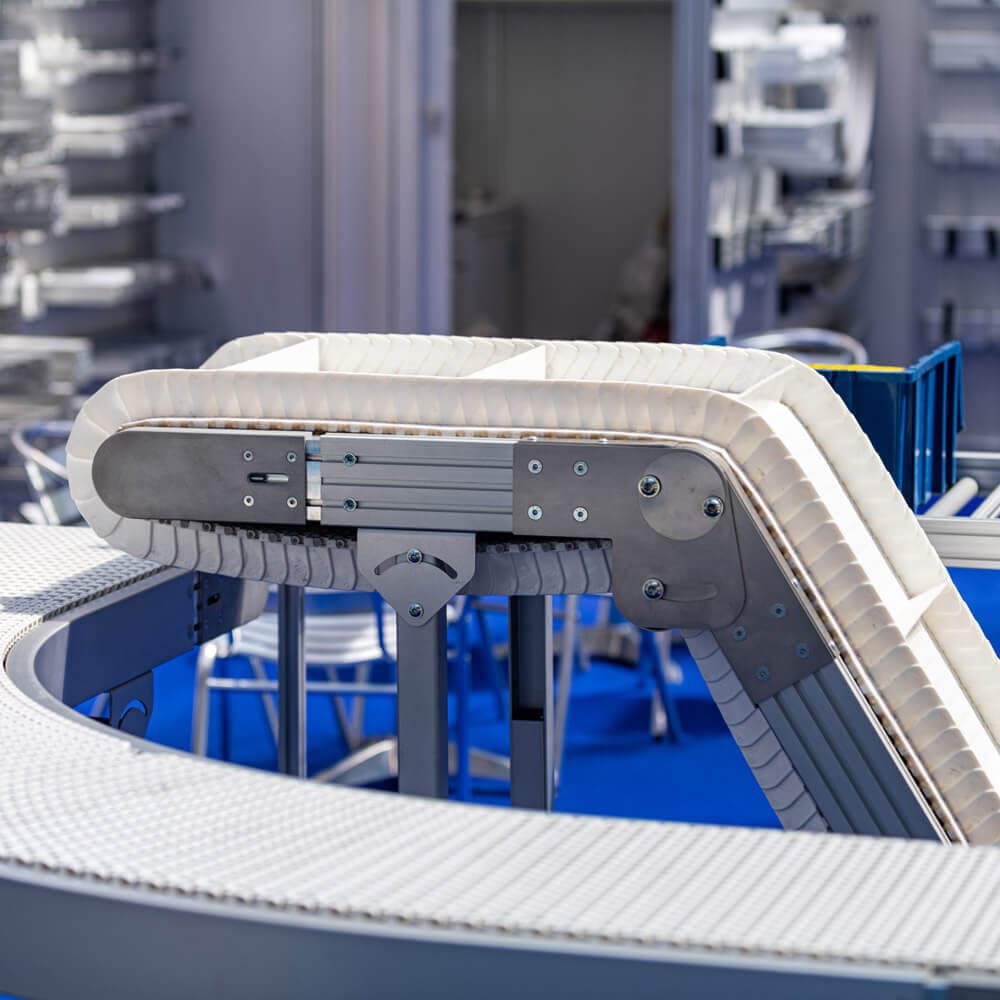

Due Diligence for the Food & Beverage Manufacturing Industry

Disruptive Process Solutions specializes in helping private equity and venture capital firms explore their opportunities in the food and beverage manufacturing sector. We specialize in building value, uncovering potential risks, validate opportunities, and make informed decisions for maximizing the impact of acquisitions.

What We Deliver

We provide comprehensive due diligence services tailored to the unique challenges of food and beverage manufacturing acquisitions:

Operational Due Diligence

- Assessing operational strengths and weaknesses for value creation

- Evaluating scalability, efficiency, and growth potential

- Conducting site visits for facility and production analysis

- Validating product costing to ensure gross margins accuracy

Food Safety and Regulatory Compliance

- Reviewing food safety management systems for FDA, USDA, FSIS compliance

- Identifying compliance issues and emerging risks

- Auditing food safety programs and employee training

- HACCP risk evaluation and allergen mitigation planning

Financial and Capital Planning

- Performing feasibility studies aligned with ROI models

- Analyzing cost structures and operational efficiencies

- Providing capital investment insights

- Budgeting for operational transition periods

Supply Chain and Market Position

- Evaluating supplier relationships and sourcing practices

- Assessing market dynamics and competitive positioning

- Identifying sustainability-driven differentiation opportunities

Soft Due Diligence

- Examining organizational structure and management expertise

- Assessing cultural alignment for post-acquisition integration

- Identifying leadership and operational risks

Our Due Diligence Process

- 1

Discovery

Understanding investment thesis and acquisition goals

- 2

Assessment

Conducting operational audits and compliance reviews

- 3

Evaluation

Providing insights on financial performance and liabilities

- 4

Recommendations

Delivering comprehensive reports with prioritized action items

Case Studies

- •Snack Manufacturer: Operational audit uncovered production bottlenecks, enabling 25% throughput increase and 15% cost reduction post-acquisition

- •Beverage Company: Identified gaps in FDA compliance during due diligence, allowing the buyer to negotiate a price adjustment

- •False Gross Margins: Analysis revealed a critical product manufactured at a loss, leading to discovery of similar costing issues across the portfolio

Other Services of Value After Due Diligence

- •Portfolio balanced strategic capital planning

- •Maintenance programming and overhaul services

- •Augmented transitional staffing

- •Turnkey engineering services

- •Turnkey process installations

- •Custom skid development

Ready to Make Informed Decisions?

Partner with DPS to ensure your food and beverage acquisitions are built on a foundation of thorough due diligence and strategic foresight.

Contact Us