The Problem with Standard Costing

PE due diligence teams are trained to spot financial red flags. What they rarely see: the hidden costs embedded in production that never appear on an income statement.

Standard costing assumes consistent labor rates, material consumption, and production efficiency. These assumptions work when processes are stable. In food manufacturing, they rarely are. A dairy plant's milk processing creates variable labor hours per unit depending on seasonal milk composition. A beverage bottling line's changeover times fluctuate based on product complexity. A meat processing facility's yield varies with animal lot quality.

Standard costing captures none of this variability. It's like flying an airplane with instruments that only measure altitude, ignoring wind, clouds, and turbulence.

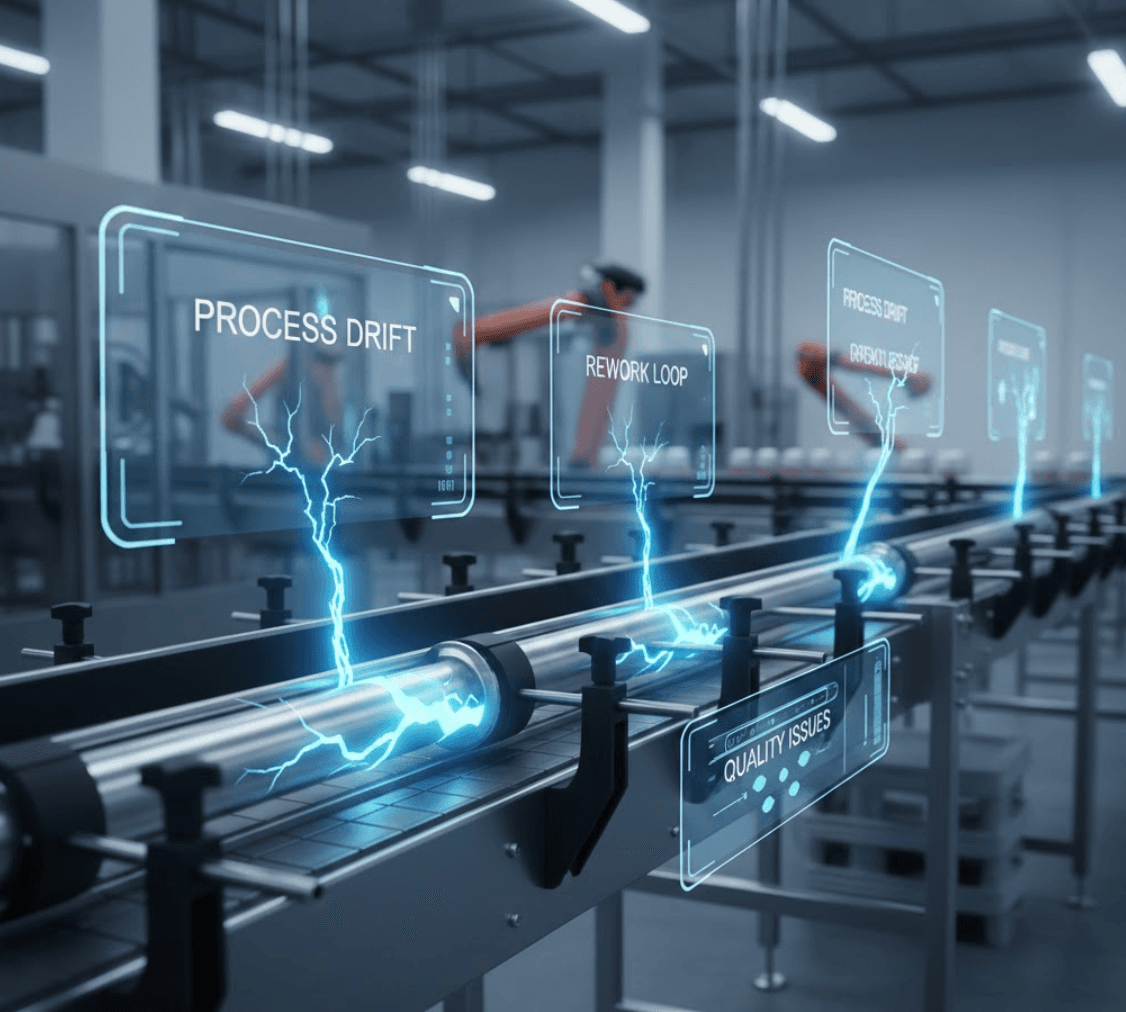

The Hidden Cost Structure

Here's what most financial statements miss:

Manufacturing excellence is measured in costs of poor quality (COPQ). Industry research shows COPQ typically represents 15-20% of total sales revenue for manufacturers. But only about 26% of that cost is visible—appearing as scrap, rework, or warranty claims. The other 74% is hidden in longer cycle times, excess inventory, and customer dissatisfaction.

A dairy manufacturer reports 88% gross margin. Using standard costing, every unit looks profitable. But actual production shows: 8% of production requires rework due to separation failures. Another 6% takes extended processing due to temperature drift. Another 4% sits in inventory longer than planned due to inconsistent scheduling.

Those hidden costs compound. When you add labor hours investigating quality issues, materials drawn to compensate for process drift, and administrative overhead addressing exceptions, the true margin drops to 72%. The 16-point difference is hidden factory capacity consumed by problems.

Why PE Firms Miss This During Due Diligence

Financial due diligence validates the historical EBITDA story. But EBITDA numbers use standard costing, which masks true operational performance. Without operational due diligence that measures actual cycle times, first-pass yields, and rework rates, PE teams inherit a business showing X% margins that will actually deliver Y% after closing.

The valuation impact is significant. A $20M revenue facility showing 35% EBITDA margins at $7M appears solid at standard multiples. If true margins are 20% due to hidden quality costs, that same facility is worth $4M. The difference comes from inherited operational problems invisible in the financial model.

The Measurement Approach

Understanding true product profitability requires tracking actual costs by product line:

- First-pass yield: percentage passing inspection on first production run

- Actual cycle time: measured production hours versus theoretical

- Rework rate: percentage of production requiring reprocessing

- Downtime: planned versus unplanned production interruptions

These metrics reveal where standard costing breaks down and hidden costs live.

For PE firms evaluating food manufacturing acquisitions, understanding true cost structure is foundational to realistic margin projections and post-close improvement planning. Technical assessment during due diligence should quantify hidden factory costs and identify where operational improvement can recover margin.