The private label food market is growing faster than branded food. Consumer value-seeking during inflationary periods drives preference toward private label products that cost 20-30% less than branded equivalents. Major retailers—Costco, Walmart, Target—are expanding private label penetration because margins are superior and customer loyalty is strong.

This creates a straightforward PE opportunity: invest in contract manufacturers (co-packers) that produce private label products for retailers.

The Investment Thesis

Private label growth is sustainable, not cyclical. Even when inflation moderates, consumers remain price-conscious. Retailers maintain private label shelf space because it's profitable. This creates predictable demand for co-packers.

The financial profile is attractive: Co-packers operate asset-light models with high fixed costs but stable margins. A co-packing facility handling 20 different product SKUs for multiple retailers spreads fixed overhead across many customers, reducing per-unit cost.

Volume growth is straightforward. A co-packer serving one retailer can add another retailer's private label production on existing equipment. Capacity utilization increases without major CapEx. This generates margin expansion post-acquisition.

The Operational Challenge

Co-packing requires operational flexibility. Customers change recipes, packaging, labeling, and production volumes with minimal notice. The facility must reconfigure without losing efficiency or incurring excessive changeover downtime.

PE firms evaluate co-packing targets by assessing:

- Changeover efficiency: How quickly can the line switch products? Slow changeovers = low utilization.

- Recipe management: Do they have systems to track ingredient specs, prevent cross-contamination, manage allergens?

- Quality consistency: Can they produce identical product across 50 production runs without variation?

- Customer communication: Do they forecast demand accurately, or are they constantly reacting to rush orders?

The best co-packing investments have operational discipline embedded. Equipment is modular. Processes are documented. Staff are trained on consistency. Data dashboards show changeover times, downtime by cause, and quality metrics.

Hidden Co-Packing Risks

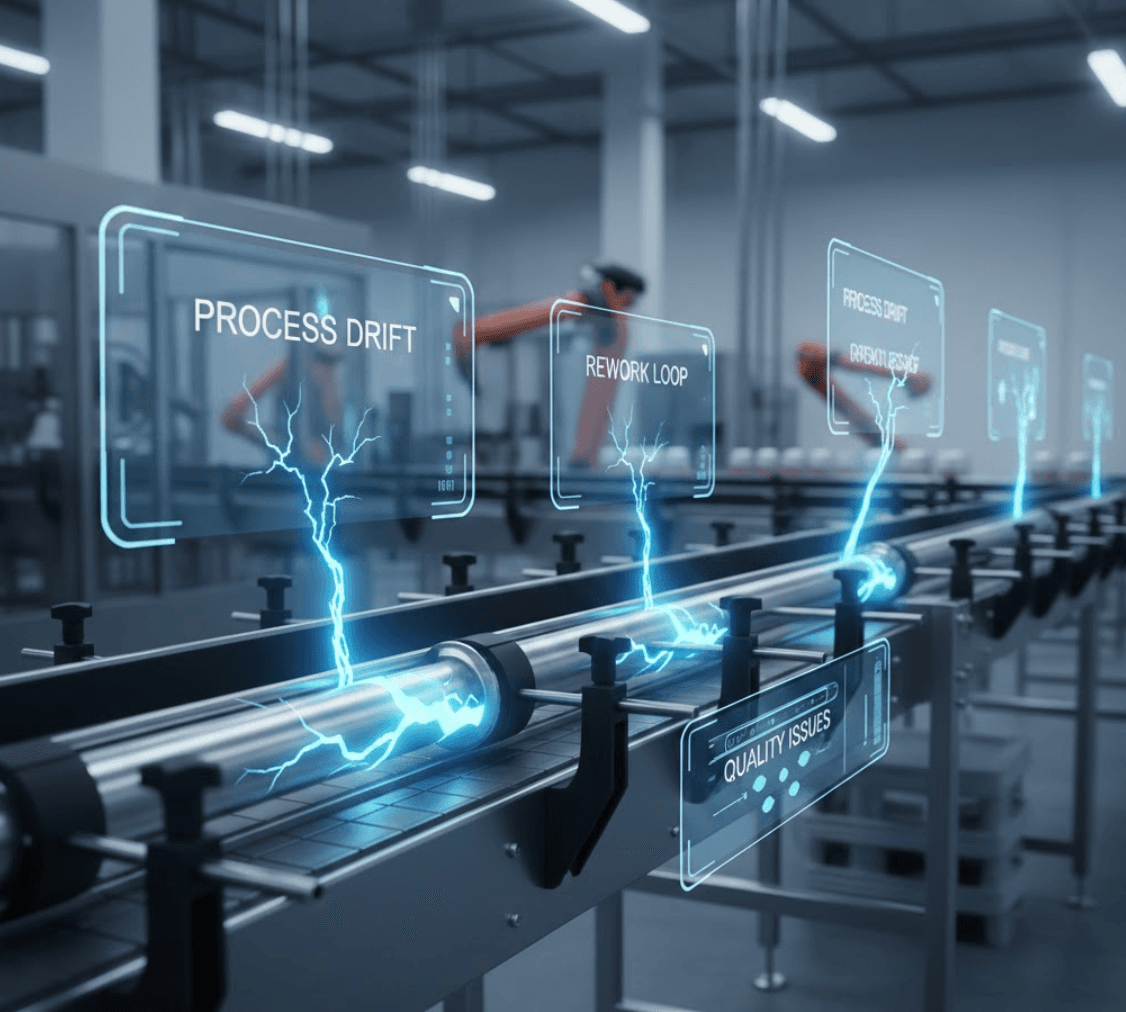

A struggling co-packer often shows specific operational problems:

- Customers consolidating to fewer suppliers (loss of revenue concentration risk)

- Unexpected recipe modifications due to ingredient availability (supply chain exposure)

- Quality hold situations that delay shipments (customer dissatisfaction)

- High rework rates due to ingredient variation (operational cost creep)

- Aggressive pricing bids that compress margins unsustainably

During operational due diligence, PE teams should assess customer concentration (percentage of revenue from top customer), customer stability (contract duration and renewal patterns), and operational responsiveness (ability to absorb recipe changes without delay).

The PE Value Creation Plan

Post-close value creation in co-packing typically focuses on operational improvements: reducing changeover time, improving first-pass yield, and adding new product capabilities. These improvements expand capacity and improve margins without requiring equipment investment.

For PE firms evaluating food manufacturing investments, co-packing platforms offer growth through consolidation and operational improvement—creating attractive IRR profiles relative to standalone facility acquisitions.