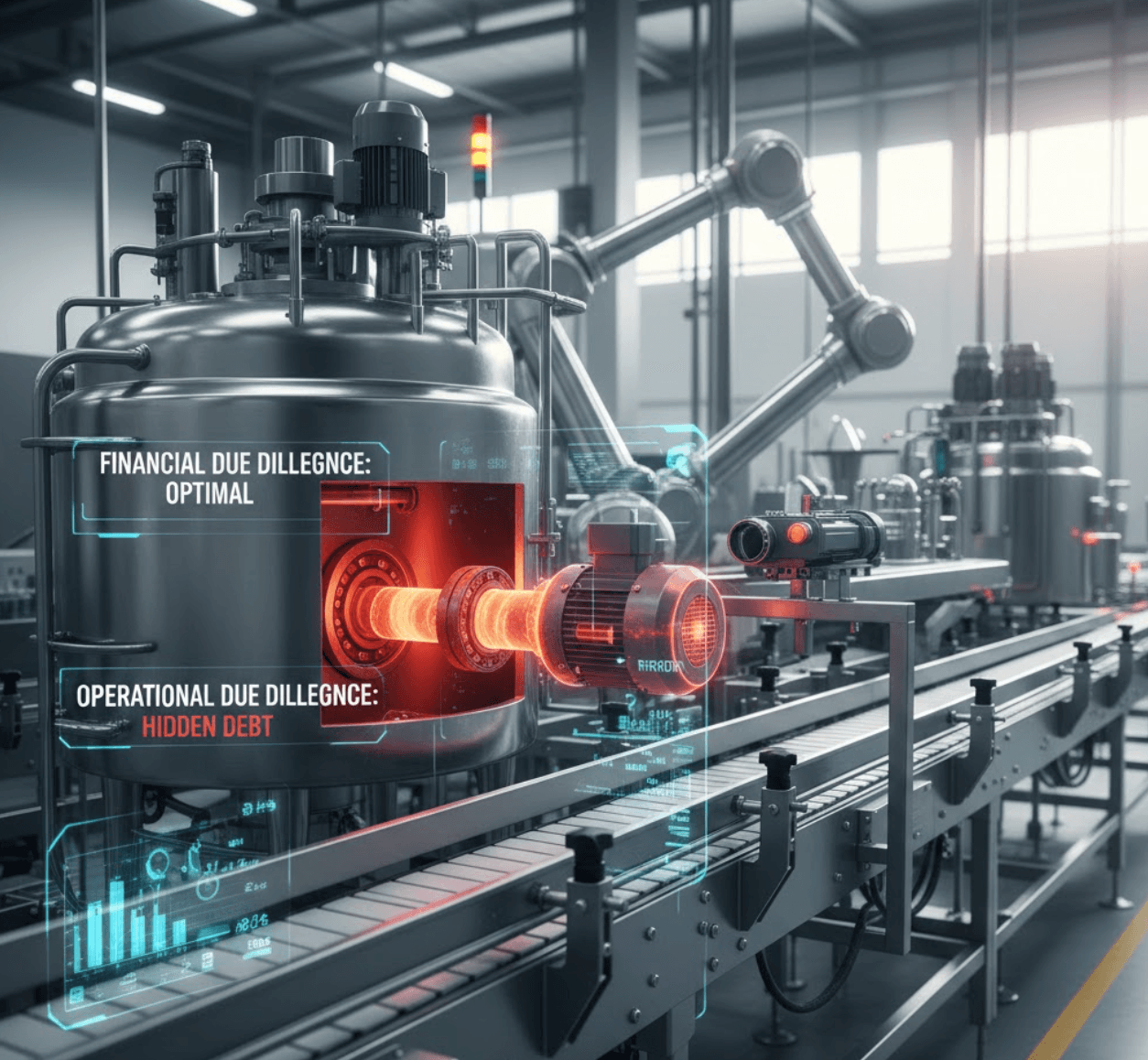

PE firms conduct financial due diligence to understand historical EBITDA. They conduct operational due diligence to understand sustainable EBITDA. What they rarely quantify: deferred maintenance.

Deferred maintenance is the equipment work that got postponed. Not because it wasn't necessary, but because it wasn't urgent. A pump bearing that's degrading. A heat exchanger that's losing efficiency. A PLC control system that's outdated. These aren't equipment failures—yet. But they're consuming hidden operational costs and depressing EBITDA.

Why Deferred Maintenance Appears in Valuation

The math is simple: every dollar of deferred maintenance that surfaces post-close is a dollar that reduces EBITDA. PE firms model this as "deferred CapEx"—an adjustment to enterprise value. If a dairy facility shows $5M EBITDA but has $800K in identified deferred maintenance, the true EBITDA for valuation purposes is closer to $4.2M.

But here's what most PE teams miss: they don't identify 100% of deferred maintenance during due diligence. They identify the obvious stuff. The hidden deferred maintenance emerges over 18-24 months post-close as equipment failures occur and operational constraints become apparent.

The Catch-Up Program Approach

Forward-thinking PE firms don't spread maintenance issues across 24 months. Instead, they execute a 6-12 month "catch-up program" in Year 1 post-close.

Why? Because strategic maintenance overhauls have positive ROI. Replacing a degraded compressor saves energy. Rebuilding a heat exchanger improves throughput. Upgrading a control system improves uptime and reduces labor. These improvements directly expand EBITDA in Year 1, allowing PE firms to achieve their original EBITDA targets despite inherited maintenance debt.

The timing is critical. If a facility runs on a January-December calendar, Q3-Q4 (July-December) provides natural maintenance windows. Many food processors slow production in summer for seasonal products. This is when 6-month maintenance overhauls happen without impacting revenue.

The Financial Treatment

Large-scale maintenance overhauls can be capitalized rather than expensed, depending on tax treatment and scope. This means the cost of catch-up programs reduces taxable income over several years, rather than hitting the P&L in Year 1. PE teams should work with their tax advisors to optimize the treatment.

The Operational Impact

Well-executed catch-up programs deliver measurable improvements: recovered production hours, reduced emergency repairs, lower labor exposure to safety risks, and improved equipment reliability.

For PE firms investing in food manufacturing, understanding deferred maintenance is critical to realistic EBITDA modeling and post-close value creation planning. Facilities with visible maintenance programs and documented equipment conditions signal lower hidden risk and faster path to operational improvements.