Most food manufacturers calculate equipment ROI using the simple formula: Net Profit / Total Investment × 100. A $200K separator that generates $50K in annual net profit shows 25% ROI. Decision approved.

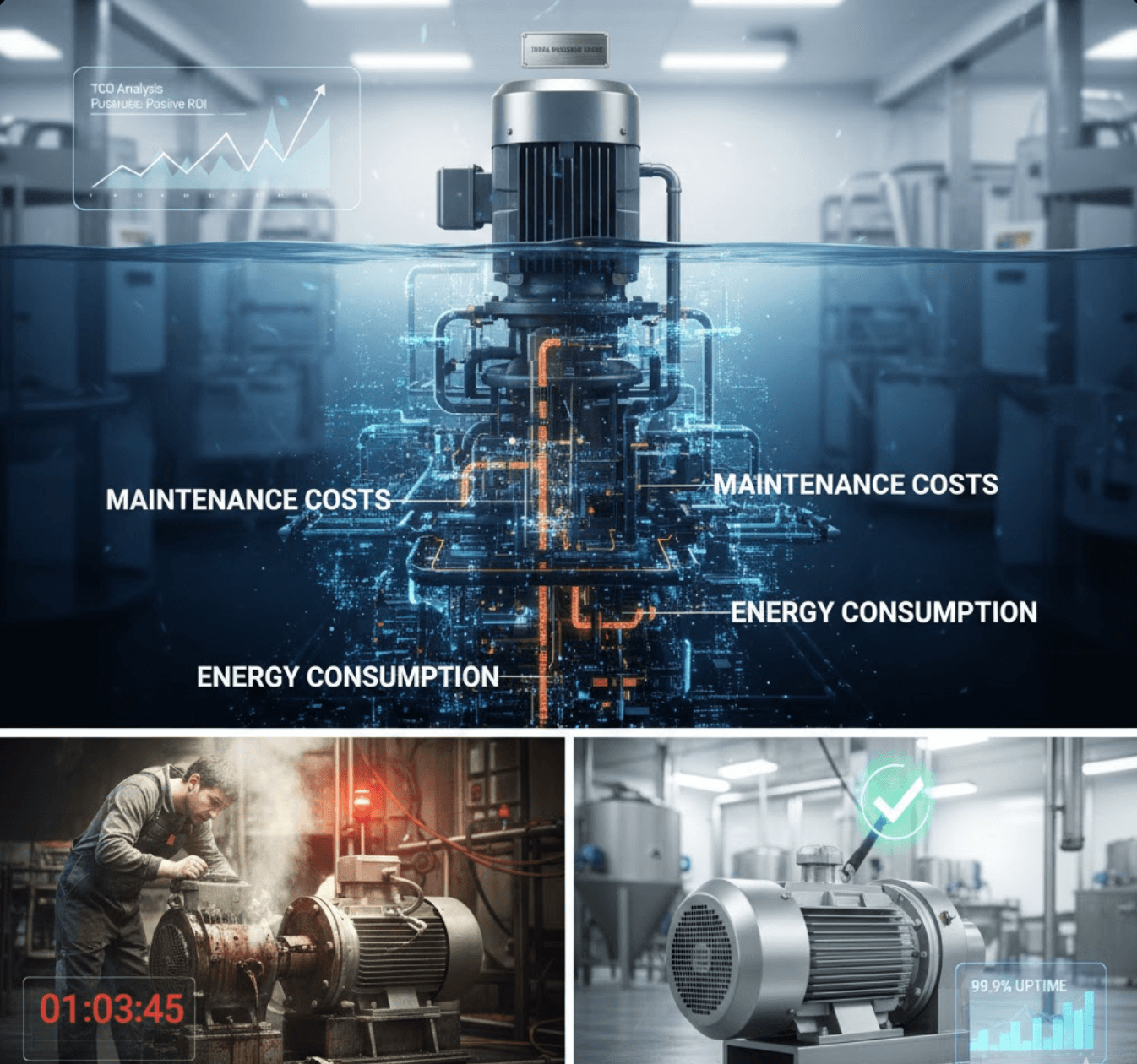

But this calculation misses the complete picture. The purchase price represents less than 10% of total cost spent on equipment over its lifetime. Energy costs, maintenance, and repair fees are predicted to have at least five times more relevance than the upfront cost.

True ROI requires understanding Total Cost of Ownership (TCO)—the collective expenses associated with purchasing and operating equipment throughout its useful life.

The TCO Formula That Changes Decisions

The total cost of ownership formula is: I + M – R = TCO

Where:

- I = Initial cost (equipment + installation + training)

- M = Maintenance costs over equipment lifetime

- R = Remaining value after depreciation

Consider two hypothetical pumps for a dairy plant. Pump A costs $10,000. Pump B costs $20,000—twice the upfront cost. Standard ROI calculation favors Pump A.

But add maintenance costs over 5 years: Pump A requires $5,000 in maintenance. Pump B requires $2,000. Factor in remaining value after depreciation: Pump A retains $2,000 resale value. Pump B retains $10,000.

TCO comparison:

- Pump A: $10,000 + $5,000 – $2,000 = $13,000

- Pump B: $20,000 + $2,000 – $10,000 = $12,000

Pump B costs $1,000 less over 5 years despite doubling the initial investment.

The Downtime Variable That Multiplies Cost

Add one more variable: downtime. Pump A experiences 3 hours of unplanned downtime annually. Pump B experiences 1 hour. A dairy processing line generates $50,000 per hour in production value.

Updated TCO:

- Pump A: $10,000 + $5,000 + $150,000 (downtime) – $2,000 = $163,000

- Pump B: $20,000 + $2,000 + $50,000 (downtime) – $10,000 = $62,000

The price gap becomes $101,000. The cheaper pump costs 2.6x more when accounting for reliability.

Why PE Firms Should Demand TCO Analysis

Food manufacturing acquisitions often inherit equipment that was purchased based on initial cost, not TCO. This creates hidden operational costs that depress EBITDA.

A facility running low-cost equipment with high maintenance needs and frequent downtime shows lower margins than a facility with higher-quality equipment and lower operational costs. This difference doesn't appear in financial statements—it appears in production logs and maintenance records.

The 10-Year View

Equipment decisions should model 10-year TCO including:

- Maintenance costs (parts, labor, contractor fees)

- Downtime costs (lost production value)

- Energy costs (operating efficiency degradation over time)

- Training costs (operator and technician certification)

- Disposal costs (end-of-life decommissioning)

For companies planning capital investments or preparing for strategic transactions, equipment TCO analysis identifies where operational improvements can reduce total ownership costs and improve facility EBITDA contribution.