Should a food manufacturer finance equipment or purchase with cash? The answer requires balancing multiple objectives—balance sheet strength, working capital management, tax implications, and operational flexibility.

Standard guidance: "Use cash when you have it." But this misses important trade-offs unique to food manufacturing.

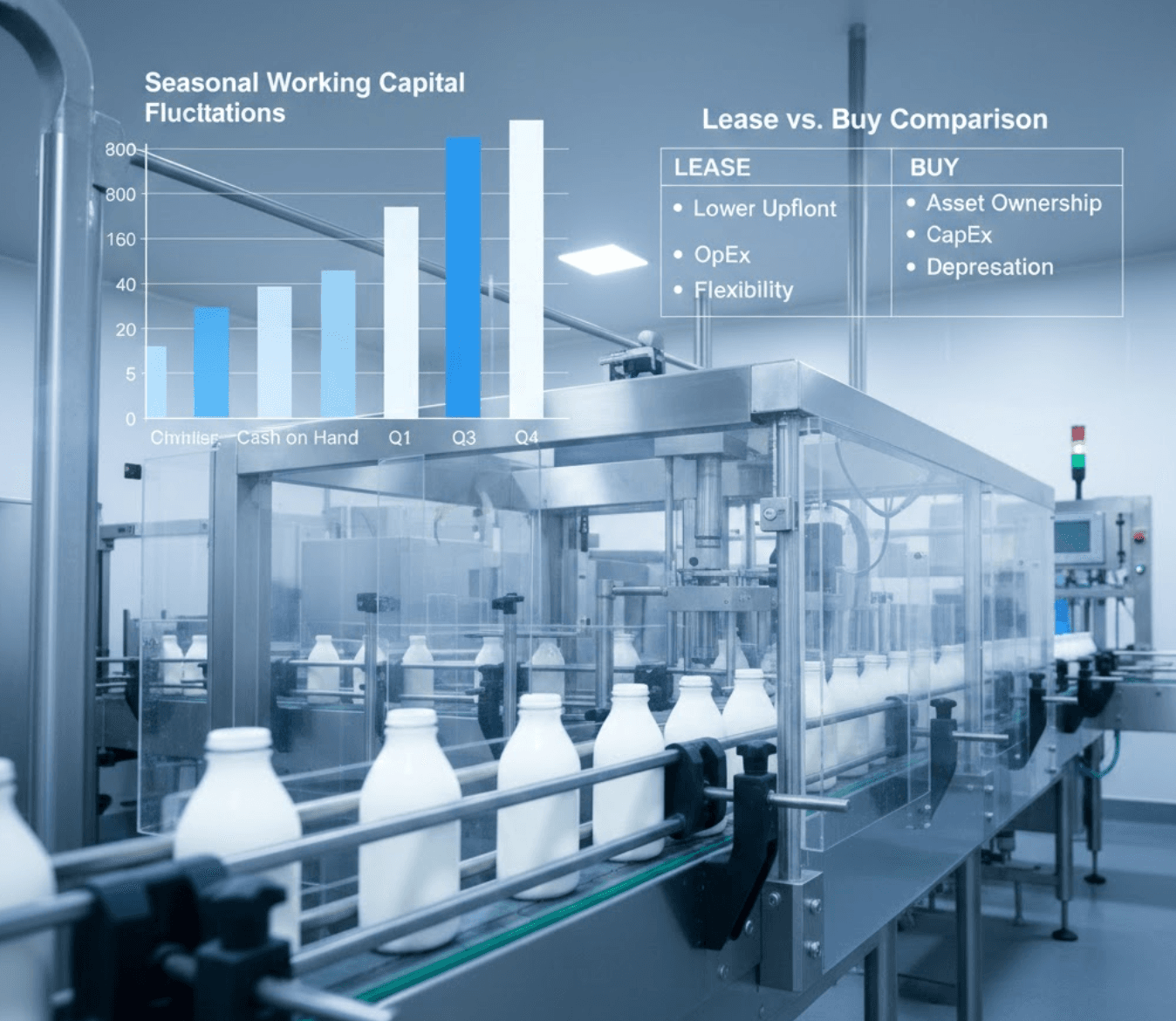

The Working Capital Argument for Financing

A dairy separator costs $250K. Purchasing it with cash reduces liquid reserves by $250K. In dairy, seasonal demand means capital requirements peak in summer (holiday product production) and decline in winter. Using cash for equipment in January might force borrowing in June when working capital needs surge.

Financing the separator preserves cash, allowing the company to manage seasonal working capital cycles without liquidity stress. The financing cost ($15K annually for a 5-year term) might be 2-3% of EBITDA—acceptable relative to the flexibility gained.

For PE platform companies managing multiple facilities with seasonal demand patterns, equipment financing preserves working capital and reduces refinancing risk.

The Tax Efficiency Argument

Equipment purchases qualify for depreciation deductions. CIP systems and processing equipment use 5-year MACRS depreciation. A $250K separator generates $50K annual depreciation deduction for 5 years.

If the company has insufficient taxable income to utilize these deductions currently, it loses the tax benefit. Financing instead of purchasing doesn't eliminate this issue—but it can allow the timing of purchases to align with higher profitability years when deductions are more valuable.

Additionally, lease arrangements sometimes offer superior tax treatment under Section 179 deductions, allowing full expensing in year one rather than depreciation over 5 years.

The Operational Flexibility Argument

Equipment financing (or leasing) provides upgrade flexibility. If a better separator technology becomes available in 3 years, a financed asset can be replaced. A purchased asset is locked in for 10+ years.

For food manufacturing facing rapid technology change (automated quality control, real-time monitoring, sustainability improvements), financing preserves optionality.

The Balance Sheet Preservation Argument

Borrowing increases debt-to-EBITDA ratios, which impacts credit ratings and future borrowing capacity. Purchasing with cash doesn't increase leverage, but it depletes cash reserves.

PE firms track leverage carefully. If a facility has stable cash flow, purchasing with cash maintains flexibility for emergency working capital or strategic acquisitions. If cash flow is seasonal or volatile, financing is safer.

The Decision Framework

Ask these questions:

- Is working capital seasonal? If yes, finance. Preserve cash for seasonal needs.

- Are equipment tax deductions useful? If yes, consider purchasing to accelerate deductions.

- Is technology changing rapidly? If yes, finance to preserve upgrade flexibility.

- Is balance sheet leverage already high? If yes, purchase with cash to avoid debt increase.

- Is cash below 60 days operating expense? If yes, finance. Maintain minimum liquidity.

For food manufacturing companies, the financing vs. purchase decision is context-dependent. Working capital seasonality, tax position, technology dynamics, and balance sheet constraints should drive the decision. Neither approach is universally correct.